Blog

by

The Inspiring Journey

The landscape of investor behavior is undergoing a tectonic shift, propelled by the transformative impact of cutting-edge technologies. As per a recent report by CNBC, the proliferation of AI-powered investment tools has led to a surge in algorithmic trading, with nearly 80% of trades in the U.S. stock market being executed by algorithms. This seismic transformation is emblematic of the profound influence wielded by technology on investor behavior, reshaping decision-making processes, risk assessment, and market participation.

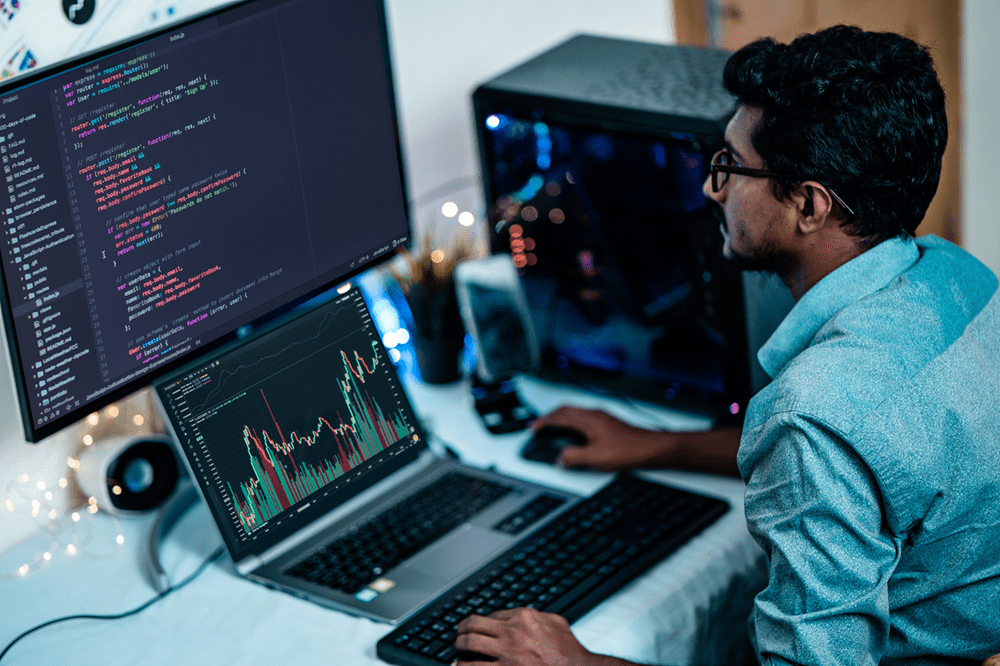

- AI-Powered Predicted Analytics: The advent of AI and machine learning has revolutionized investor behavior, empowering market participants with predictive analytics capabilities that discern intricate patterns, anticipate market trends, and optimize investment strategies. According to a study by Forbes, AI-driven predictive models have exhibited a outstanding accuracy in forecasting stock movements, prompting a increase in their adoption among institutional and retail investors alike.

- Blockchain and Cryptocurrency Disruption: The disruptive potential of blockchain and cryptocurrencies has engendered a paradigm shift in investor behavior, spawning a fervent interest in digital assets and decentralized finance (DeFi). Notably, the meteoric rise of Bitcoin and Ethereum, underscored by a report from Reuters, has galvanized a new wave of investors, recreating traditional portfolio allocations and prompting a reevaluation of risk appetite and diversification strategies.

- Robo-Advisors and Automated Portfolio Management: Robo-advisors, as per a study by The Wall Street Journal, have emerged as a game-changer in the realm of wealth management, offering automated portfolio allocation, rebalancing, and personalized investment advice. This technological innovation has democratized access to sophisticated investment strategies, fostering a shift in investor behavior characterized by a reliance on data-driven insights and algorithmic decision-making processes.

- Social Media and Crowd-Sourced Investing: The pervasive influence of social media platforms, exemplified by the Reddit-fueled GameStop saga, has catalyzed a surge in crowd-sourced investing and collaborative due process. Notably, a report by Bloomberg underscores the impact of social media sentiment on stock prices, highlighting the evolving role of technology in shaping investor sentiment and market dynamics.

- High-Frequency Trading and Market Liquidity: The proliferation of high-frequency trading (HFT) strategies, as explained by a study in The Financial Times, has redefined market liquidity and price discovery mechanisms, exerting a palpable influence on investor behavior. The prevalence of HFT algorithms has engendered a shift towards rapid-fire trading and heightened sensitivity to micro-market movements, underscoring the pervasive impact of technology on investor decision-making processes.

In summation, the confluence of technological innovations has precipitated a seismic shift in investor behavior, redefining market dynamics, risk assessment methodologies, and investment strategies. As investors navigate this brave new world shaped by AI, blockchain, and algorithmic trading, the imperative of embracing technological prowess and harnessing data-driven insights becomes indispensable, heralding a new era of investor behavior characterized by agility, foresight, and a symbiotic relationship with cutting-edge technologies.