Blog

by

The Inspiring Journey

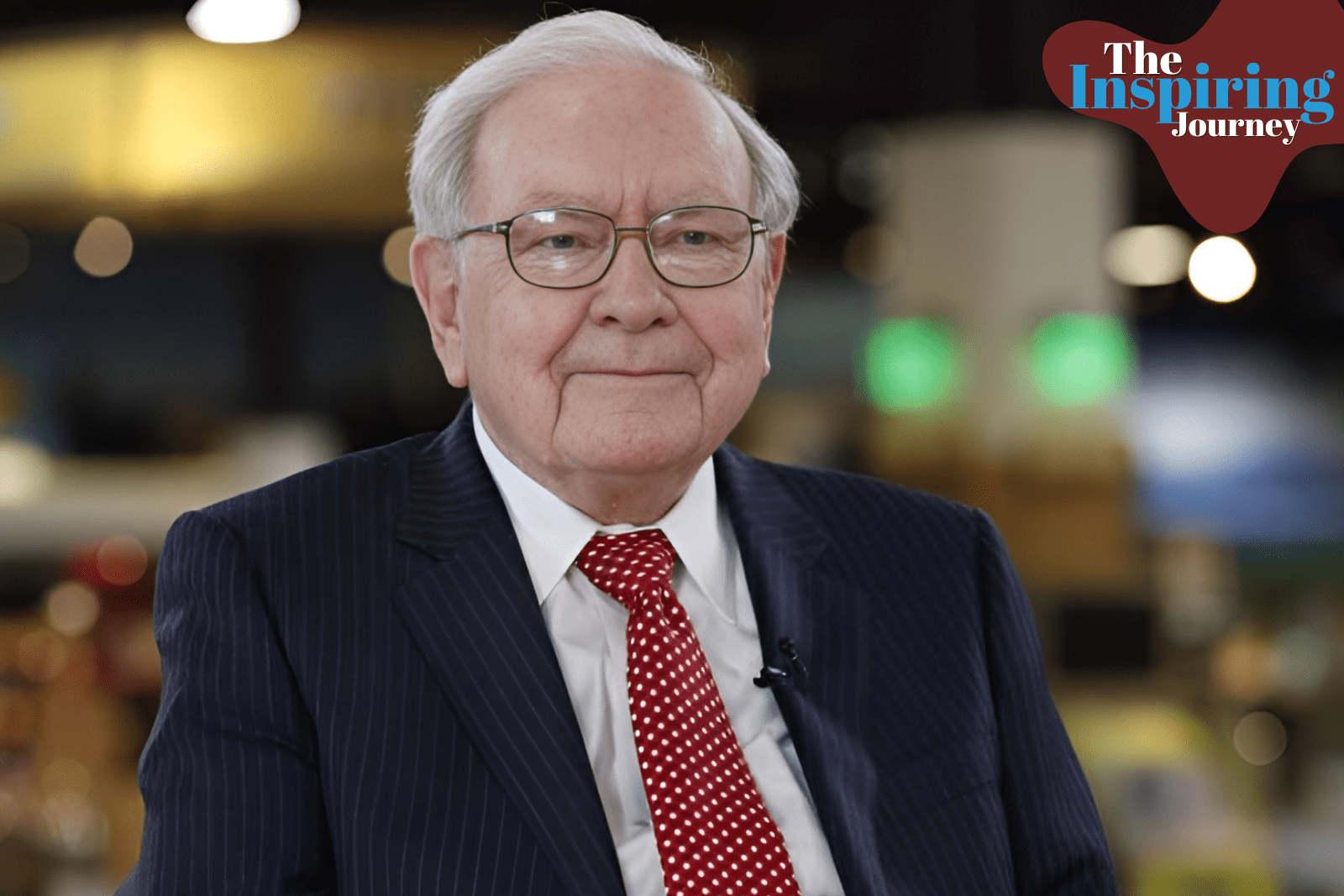

Warren Buffett, the “Oracle of Omaha,” is a legend in the world of investing. His folksy wisdom and long-term approach have not only made him one of the richest people in the world, but also a source of inspiration for aspiring investors and anyone seeking success. In this article, we’ll delve into six of Buffett’s most powerful quotes, unpacking their meaning and how they can be applied to your own life.

- “Rule Number 1: Never lose money. Rule Number 2: Never forget rule number 1.”

This seemingly simple rule is the cornerstone of Buffett’s investing philosophy. It emphasizes the importance of risk management and capital preservation. It’s not about getting rich quick, but about protecting what you have and making sound decisions that ensure your financial well-being over the long term.

- “Someone’s sitting in the shade today because someone planted a tree a long time ago.”

This quote highlights the power of delayed gratification and long-term thinking. Success rarely happens overnight. Just like a tree takes time to grow and provide shade, achieving your goals often requires consistent effort and patience. The decisions you make today will have a ripple effect on your future.

- “If you aren’t willing to own a stock for 10 years, don’t even think about owning it for 10 minutes.”

Buffett is a proponent of value investing, focusing on companies with strong fundamentals and holding them for the long term. This quote discourages chasing short-term market trends and emphasizes the importance of understanding the underlying business before investing.

- “It’s far better to buy a wonderful company at a fair price, than a fair company at a wonderful price.”

This gem reminds us not to be tempted by bargain-basement stocks with weak fundamentals. While a low price tag might seem attractive, it’s crucial to invest in companies with a proven track record and sustainable competitive advantages.

- “Be fearful when others are greedy, and be greedy when others are fearful.”

This quote captures the essence of contrarian investing. When the market is euphoric and everyone is buying, it might be a sign to be cautious. Conversely, when there’s panic and pessimism, it could be an opportune time to invest in undervalued companies.

- “It’s better to hang out with people better than you. Pick out associates whose behavior is better than yours and you’ll drift in that direction.”

Buffett recognizes the power of surrounding yourself with positive influences. By associating with people who are smarter, more successful, and have better habits, you’ll naturally learn from them and elevate your own thinking.

Who Can Benefit from These Quotes?

These quotes are not just for aspiring investors. The principles of risk management, long-term thinking, patience, and surrounding yourself with positive influences can be applied to any aspect of life. Whether you’re looking to build a successful career, achieve personal goals, or simply improve your decision-making, Buffett’s wisdom offers valuable insights.

By understanding and applying these timeless quotes, you can invest in yourself, make sound choices, and pave the way for a brighter future. So, take a page from Buffett’s book, and start building your own legacy today.

Welcome to The Inspiring Journey, where we are constantly seeking for amazing stories that could brighten your day and bring positive change in society. Our platform is a place where you can find tales of startups making a difference, social media stars who are making real impacts, and leaders whose stories inspire action, innovations making changes.

Think of stumbling on a founder’s story about facing difficulty head-on and turning it around for the better; dreams that eventually came true despite of all odds faced by such startup founders. Or better yet still, there may be some social media influencer with an honest outcry who are making a positive change in society. These stories are our guiding words – stories of strength, new ideas, and never giving up.