Blog

by

The Inspiring Journey

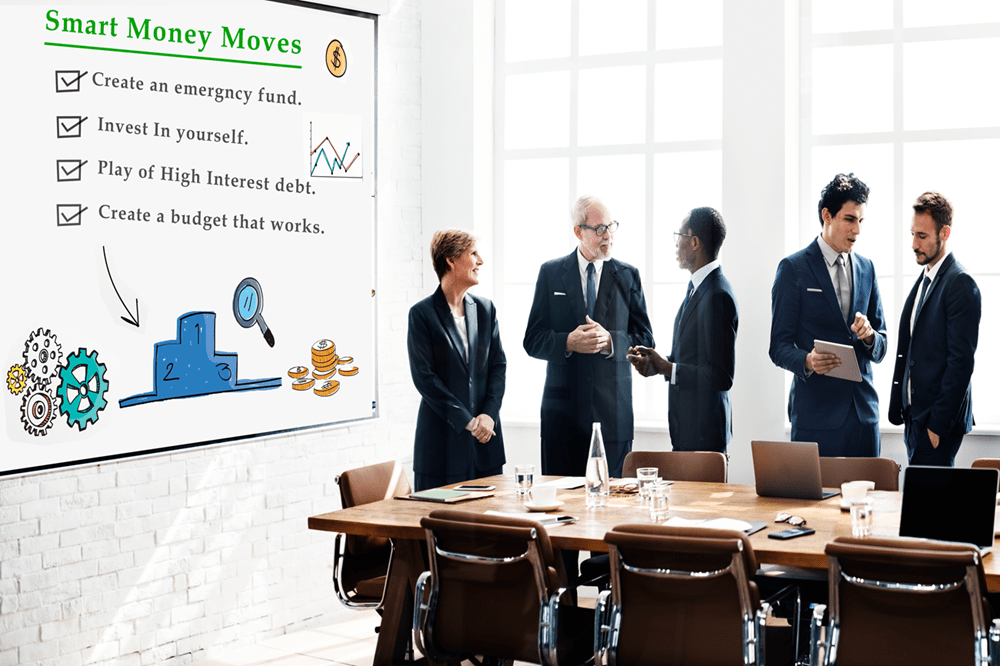

In the always evolving landscape of personal finance, mastering the art of Budget Finance is a cornerstone for achieving lasting financial freedom. At The Inspiring Journey, we understand the crucial role that effective budgeting plays in individuals’ lives. This detailed guide aims to equip you with the essential tools and insights to sculpt a personalized budget, laying the foundation for a secure financial future.

What is Budget Finance?

Budget Finance is a strategic plan that empowers individuals to manage their money effectively. It’s not just about restricting spending but rather a roadmap that aligns income with expenses, savings, and financial goals.

The Importance of a Personal Budget :A well-crafted Personal Budget serves as a financial compass, guiding you through life’s uncertainties. It helps to prevent overspending, cultivates saving habits, and ensures you are prepared for unexpected expenses.

Crafting Your Budget

Assessing Your Income: The first step in creating a robust budget is understanding your cash inflow. This includes your primary income, side hustles, or any additional revenue streams. Precise knowledge of your earnings lays the groundwork for informed financial decisions.

Identifying Fixed and Variable Expenses: Distinguish between fixed and variable expenses to gain clarity on your spending patterns. Fixed costs, such as rent and utilities, remain constant, while variable expenses, like dining out or entertainment, fluctuate. This insight aids in prioritizing and adjusting spending habits accordingly.

Setting Realistic Goals: Establish short-term and long-term financial goals. Whether it’s an emergency fund, debt repayment, or saving for a dream vacation, clear objectives provide motivation and direction in your budgeting journey.

Budgeting Tools and Strategies

Utilizing Technology: In the digital age, leverage cutting-edge budgeting apps to streamline the process. Apps like Mint or YNAB sync with your accounts, categorize transactions, and provide real-time insights into your financial health.

Using the 50/30/20 Rule

Allocate your income systematically with the 50/30/20 rule – 50% for necessities, 30% for discretionary spending, and 20% for savings and debt repayment. This simple yet effective strategy ensures a balanced approach to budgeting.

Overcoming Challenges

Dealing with Debt: Addressing outstanding debts is paramount to financial well-being. Prioritize high-interest debts and develop a systematic plan for repayment. This proactive approach not only reduces financial stress but also accelerates your journey towards financial freedom.

Adapting to Life Changes: Life is dynamic, and so should be your budget. Regularly reassess and adjust your financial plan to accommodate life changes such as career shifts, marriage, or the arrival of children. Flexibility is key to maintaining a sustainable budget.

Monitoring and Adjusting

Regular Financial Check-ins: Schedule periodic reviews of your budget to ensure alignment with your goals. Identify areas of overspending or potential savings, enabling you to make informed adjustments.

Celebrating Milestones: Acknowledge and celebrate financial milestones, whether it’s paying off a significant portion of debt or reaching a savings goal. Positive support enhances your commitment to the budgeting process.

Mastering Budget Finance is a journey towards financial empowerment. By understanding your income, managing expenses, and embracing strategic tools, you pave the way for a secure and prosperous future. At The Inspiring Journey, we are committed to supporting you in this journey, offering insights and tools to guiding the complex world of personal finance.