Blog

by

The Inspiring Journey

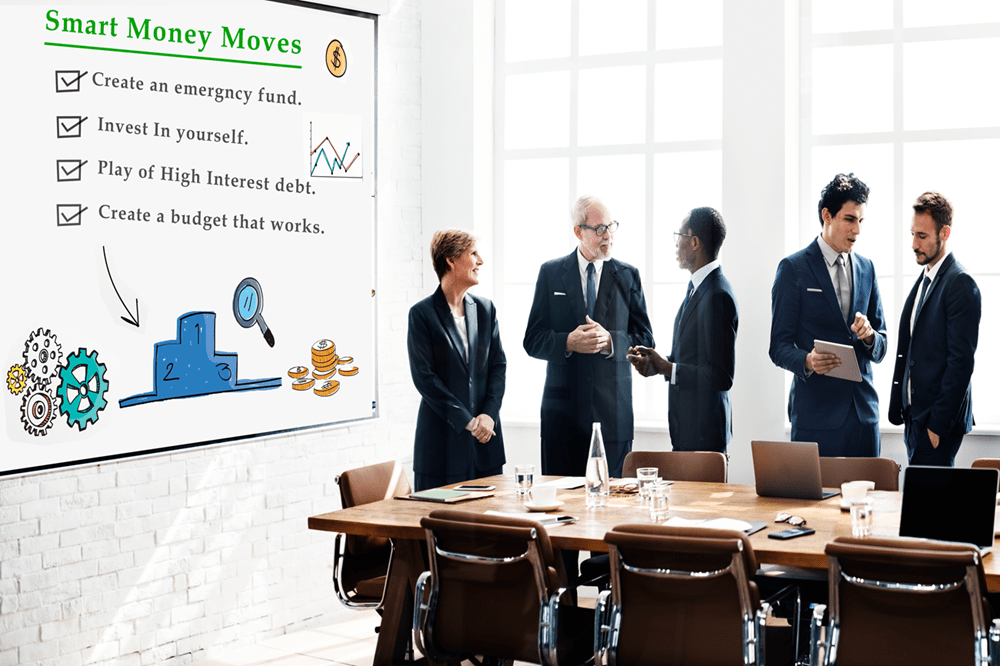

Embarking on a journey towards financial success requires more than just earning money; it demands strategic planning and informed decision-making. In this guide, we present “Smart Money Moves,” a comprehensive playbook designed to guide you through the nuances of crafting a robust Financial Plan for Success.

Understanding Financial Planning

Financial planning is the cornerstone of building a secure and prosperous future. It involves a systematic approach to managing finances, encompassing budgeting, savings, investments, and goal setting.

The Significance of a Financial Plan for Success

A well-crafted Financial Plan for Success acts as a roadmap, steering you through the complexities of financial decisions. It not only provides a framework for managing resources but also aligns your financial goals with actionable steps for achievement.

Crafting Your Financial Plan

Assessing Your Current Financial Situation: Before crafting a plan, evaluate your current financial standing. This includes income, expenses, debts, and assets. Understanding your financial landscape sets the stage for realistic goal setting.

Setting SMART Financial Goals: Define Specific, Measurable, Achievable, Relevant, and Time-bound (SMART) financial goals. Whether it’s saving for a home, funding education, or retirement planning, clear objectives provide direction and motivation.

Creating a Budget: A detailed budget is the foundation of any financial plan for success. Categorize your expenses, allocate funds for necessities, savings, and discretionary spending. Regularly review and adjust your budget to stay on track.

Implementing Smart Money Moves

Building an Emergency Fund: A crucial component of financial planning is the establishment of an emergency fund. This safety net ensures you are prepared for unforeseen expenses, preventing financial setbacks.

Investing Strategically: Explore investment avenues aligned with your risk tolerance and financial goals. Diversify your portfolio to mitigate risk, and consider long-term growth strategies for wealth accumulation.

Managing Debt Wisely: Effective financial planning includes a strategy for managing and reducing debt. Prioritize high-interest debts and develop a systematic plan for repayment to free up resources for other financial goals.

Navigating Life Changes

Adapting Your Financial Plan: Life is dynamic, and your financial plan should adapt accordingly. Regularly revisit and adjust your plan to accommodate changes such as job transitions, marriage, or the birth of a child.

Seeking Professional Advice: Consider consulting a financial advisor to fine-tune your financial plan for success. An experienced advisor provides insights, addresses concerns, and ensures your plan aligns with your long-term objectives.

Monitoring and Celebrating Success

Regular Financial Check-ins: Schedule regular reviews of your financial plan. Evaluate progress, identify areas for improvement, and make necessary adjustments to keep your plan dynamic and effective.

Celebrating Financial Milestones: Acknowledge and celebrate achievements along your financial journey. Whether it’s reaching a savings goal, paying off debt, or achieving investment milestones, recognizing success reinforces commitment.

“Smart Money Moves” serves as your playbook for financial success. By understanding the essence of financial planning and implementing strategic moves, you pave the way for a secure and prosperous future.